PREVIOUS

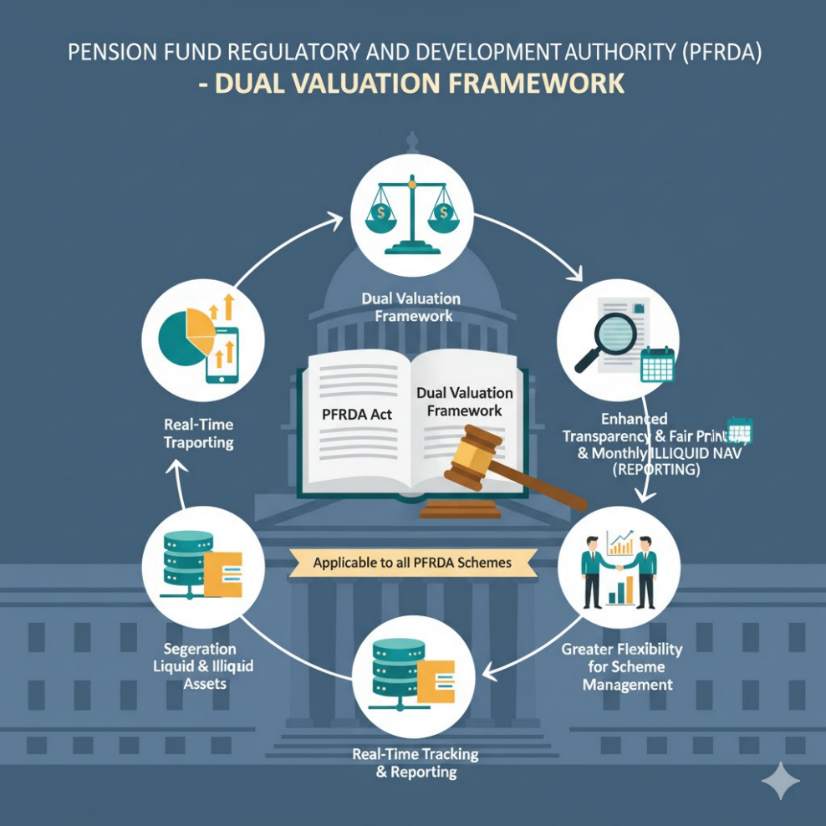

Dual Valuation Framework

October 28 , 2025

16 hrs 0 min

13

0

- The Pension Fund Regulatory and Development Authority (PFRDA) has proposed a dual valuation framework for government securities in the National Pension Scheme (NPS) and Atal Pension Yojana (APY).

- The proposal suggests using both mark-to-market and accrual or held-to-maturity (HTM) valuation methods for government securities.

- Currently, NPS investments are valued on a mark-to-market basis, which reflects daily market prices.

- The accrual or HTM method recognizes interest income daily while avoiding short-term price fluctuations.

- The dual valuation approach allows pension funds to manage liquid securities actively while holding long-term government securities at stable values.

Leave a Reply

Your Comment is awaiting moderation.