PREVIOUS

GST compensation levy

September 3 , 2025

16 hrs 0 min

39

0

- In the Goods and Services Tax (GST) Council meeting on September 3 and 4, a group of eight non-BJP ruled States have proposed a cess to be levied on sin and luxury goods over and above the proposed 40% GST rate.

- Without such a cess, the revenue losses from the Centre’s proposed rate rationalisation hamper at least 15% of their expenditure on development.

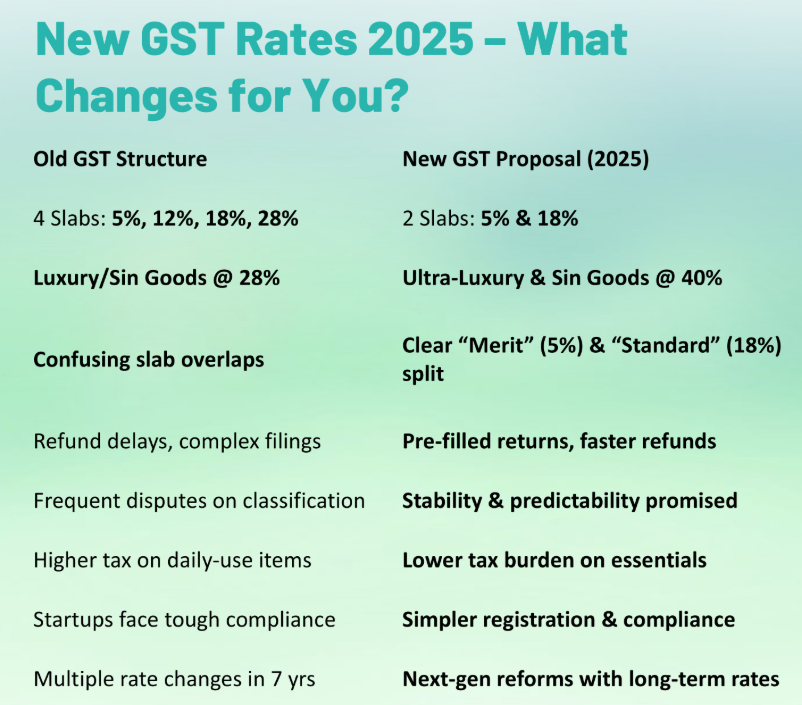

- The Centre has proposed removing the 12% and 28% tax slabs and moving the vast majority of items in these slabs to 5% and 18%, respectively.

- It has also proposed a 40% rate for a few sin and luxury items.

- Assam, Chhattisgarh, Gujarat, Madhya Pradesh and Uttar Pradesh favour the proposal to allocate a GST rate without an additional tax.

- West Bengal, Tamil Nadu, Punjab and Karnataka support the continuation of cess via an additional levy.

Leave a Reply

Your Comment is awaiting moderation.