PREVIOUS

RBI Banking Reforms

October 10 , 2025

14 hrs 0 min

32

0

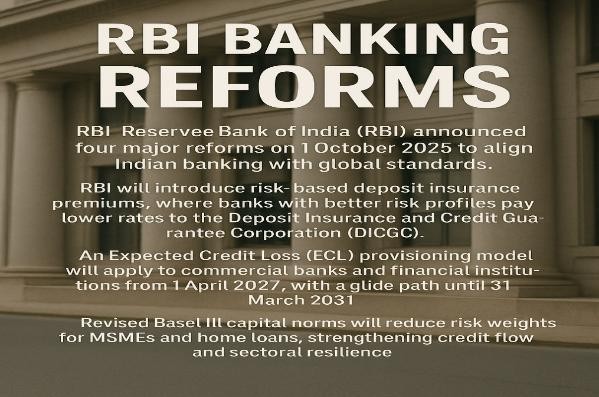

- The Reserve Bank of India (RBI) announced four major reforms on 1 October 2025 to align Indian banking with global standards.

- RBI will introduce risk-based deposit insurance premiums.

- Under this, the Banks with better risk profiles pay lower rates to the Deposit Insurance and Credit Guarantee Corporation (DICGC).

- An Expected Credit Loss (ECL) provisioning model will apply to commercial banks and financial institutions from 1 April 2027, with a glide path until 31 March 2031.

- Revised Basel III capital norms will reduce risk weights for MSMEs and home loans, strengthening credit flow and sectoral resilience.

- RBI will implement new investment and business guidelines, removing restrictions on business overlap with group entities and giving boards more decision-making power.

Leave a Reply

Your Comment is awaiting moderation.