PREVIOUS

RBI Report on Banking

January 2 , 2026

12 hrs 0 min

20

0

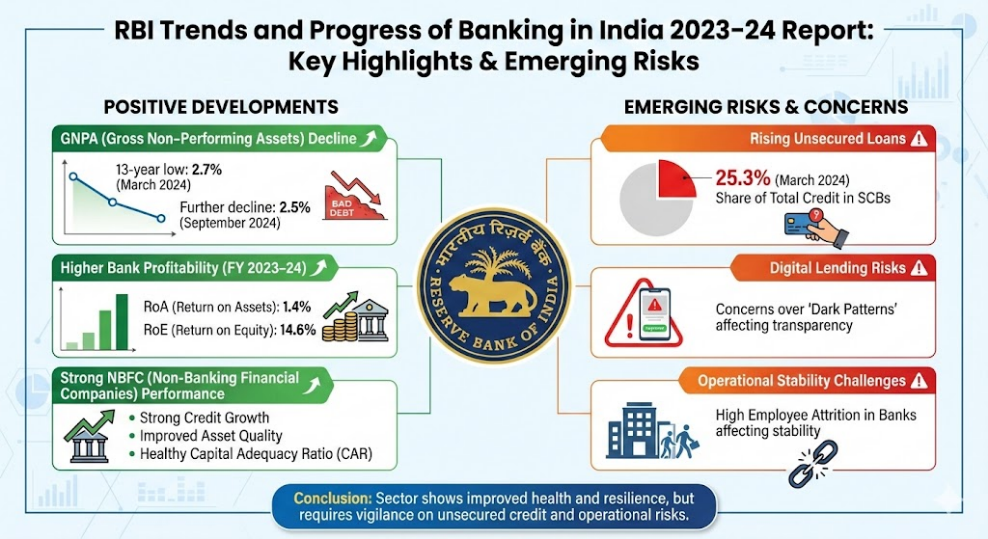

- The RBI released the Trends and Progress of Banking in India 2023–24 report, highlighting emerging risks in the banking sector.

- Gross Non-Performing Assets (GNPA) declined to a 13-year low of 2.7% in March 2024 and further to 2.5% by September 2024.

- Banks have recorded higher profitability, with Return on Assets (RoA) at 1.4% and Return on Equity (RoE) at 14.6% in Financial Year (FY) 2023–24.

- The RBI flagged concerns over the rising share of unsecured loans, which accounted for 25.3% of total credit in Scheduled Commercial Banks (SCBs) by March 2024.

- Non-Banking Financial Companies (NBFCs) showed strong credit growth with improved asset quality and a healthy Capital Adequacy Ratio (CAR).

- The report also noted risks from dark patterns in digital lending and high employee attrition in banks, affecting operational stability.

Leave a Reply

Your Comment is awaiting moderation.