PREVIOUS

Tamil Nadu Assured Pension Scheme (TAPS) analysis

January 7 , 2026

12 hrs 0 min

181

0

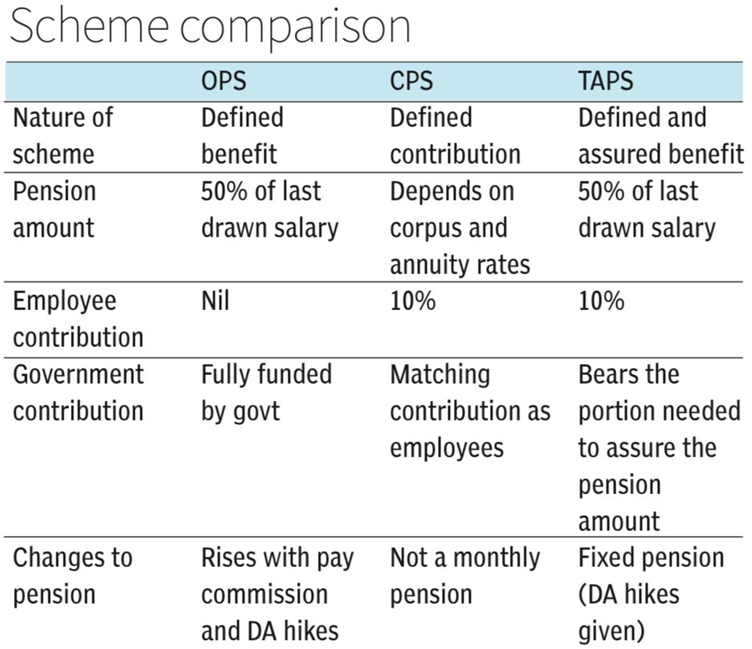

- It is virtually a replica of the Old Pension Scheme (OPS).

- It is also an improved version of the Unified Pension Scheme (UPS).

- Except for the monthly individual contribution and pension revision at the time of constitution of every pay commission, the proposed pension scheme follows the broad guidelines of the OPS.

- One of the key features of the OPS is death-cum-retirement gratuity (DCRG).

- For instance, in the event of death in harness of those whose length of service is 20 years or more, gratuity not exceeding ₹25 lakh will be paid.

- This aspect has been included in the TAPS.

- As in the case of the OPS, family pension will be equivalent to 60% of the pension.

- Inflation indexation will also be made.

- Pension under the TAPS will be based on 50% of the pay drawn in the last month of service whereas it is 50% of the average of the last 12 months’ basic pay under the UPS.

- On death of the pensioner under the UPS, only the legally wedded spouse is eligible to receive the family payout, whereas the family — meaning legal heirs nominated by the pensioner — will be covered in the case of the TAPS.

- While in the UPS, a minimum assured payout is made if superannuation is after 10 years or more of qualifying service.

- Under the TAPS, it will be given regardless of the length of service.

- All the existing employees under the Contributory Pension Scheme (CPS), numbering approximately 6.24 lakh, are expected to migrate to the TAPS, even though they will be allowed to choose their pension scheme.

- The government has decided to invest pension funds with the Pension Fund Regulatory and Development Authority (PFRDA) instead of the Life Insurance Corporation (LIC).

- Till now, the entire accrued amount under the CPS, which covers those who joined the government service on or after April 1, 2003, is invested in the Superannuation Fund of the LIC.

- Comptroller and Auditor General (CAG) blamed the state government for not using the PFRDA to invest funds, as such a move would have yielded higher returns.

- A CAG report on State finances for 2023-24, tabled in the Assembly in October 2025, stated: “Previously, the State invested DCPS [Defined Contributory Pension Scheme or CPS] accumulations in both LIC and Treasury Bills, which yielded lower interest than the General Provident Fund rate.

- This issue was highlighted in previous SFAR [State Finances Audit Report] reports.

- Currently, the State is investing DCPS accumulations solely in LIC, with interest rates aligned with the General Provident Fund rate, currently set at 7.1%.”

- Projections have been made regarding the growth rate of State Own Tax Revenue (SOTR) at least for the next 15 years.

- Despite the increase in the value of allocation every year, the proportion of pension liability will stabilise around 21% to 22% of the SOTR.

- As per the CAG report for 2023-24, the share of pensions and other retirement benefits was 22.5%, as pensions amounted to ₹37,696.81 crore and the SOTR stood at ₹1,67,279 crore.

Leave a Reply

Your Comment is awaiting moderation.