PREVIOUS

Union Budget 2020-21

- Finance Minister Nirmala Sitharaman presented the Union Budget 2020-21 in the Lok Sabha on 1st February 2020.

- This is the second budget after Narendra Modi led National Democratic Alliance returned to power for a second term. This year's Union Budget centres around three ideas — Aspirational India, Economic development, A Caring Society.

Three prominent themes of the Budget

- Aspirational India - better standards of living with access to health, education and better jobs for all sections of the society

- Economic Development for all - “Sabka Saath , Sabka Vikas , Sabka Vishwas”.

- Caring Society - both humane and compassionate; Antyodaya as an article of faith.

- Three broad themes are held together by:

- Corruption free, policy-driven Good Governance.

- Clean and sound financial sector.

- Ease of Living underlined by the three themes of Union Budget 2020-21.

Three components of Aspirational India

- Agriculture, Irrigation, and Rural Development

- Wellness, Water, and Sanitation

- Education and Skills

1.Sixteen Action Points for Agriculture, Irrigation and Rural Development

- Rs. 2.83 lakh crore to be allocated for the 16 Action Points:

- Rs. 1.60 lakh crore for Agriculture, Irrigation & allied activities.

- Rs. 1.23 lakh crore for Rural development & Panchayati Raj.

Agriculture Credit

- Rs. 15 lakh crore targets for Agriculture credit set for the year 2020-21.

Blue Economy

- Rs. 1 lakh crore fisheries’ exports to be achieved by 2024-25.

- 200 lakh tonnes fish production targeted by 2022-23.

Kisan Rail to be setup by Indian Railways through PPP:

- To build a seamless national cold supply chain for perishables (milk, meat, fish, etc.)

- Express and Freight trains to have refrigerated coaches.

Krishi Udaan to be launched by the Ministry of Civil Aviation:

- Both international and national routes to be covered.

- North-East and tribal districts to realize Improved value of agri-products.

- One-Product One-District for better marketing and export in the Horticulture sector.

Measures for organic, natural, and integrated farming

- Jaivik Kheti Portal – online national organic products market to be strengthened.

- Zero-Budget Natural Farming (mentioned in July 2019 Budget) to be included.

PM-KUSUM to be expanded

- 20 lakh farmers to be provided for setting up stand-alone solar pumps.

Village Storage Scheme

- Women, SHGs to regain their position as Dhaanya Lakshmi

Livestock:

- Doubling of milk processing capacity to 108 million MT from 53.5 million MT by 2025.

- Artificial insemination to be increased to 70% from the present 30%.

- MNREGS to be dovetailed to develop fodder farms.

- Foot and Mouth Disease, Brucellosis in cattle and Peste Des Petits ruminants (PPR) in sheep and goat to be eliminated by 2025.

2. Wellness, Water and Sanitation

- Rs. 69,000 crores allocated for overall Healthcare sector.

- Targeting diseases with an appropriately designed preventive regime using Machine Learning and AI.

- Jan Aushadhi Kendra Scheme to offer 2000 medicines and 300 surgical in all districts by 2024.

- TB Harega Desh Jeetega campaign launched - commitment to end Tuberculosis by 2025.

3. Education and Skills

- Rs. 99,300 crores for education sector and Rs. 3000 crores for skill development in 2020-21.

- New Education Policy to be announced soon.

- National Police University and National Forensic Science University proposed for policing science, forensic science, and cyber-forensics.

- Degree level full-fledged online education program by Top-100 institutions in the National Institutional Ranking Framework.

- Up to 1-year internship to fresh engineers to be provided by Urban Local Bodies.

- Budget proposes to attach a medical college to an existing district hospital in PPP mode.

- 150 higher educational institutions to start apprenticeship embedded degree/diploma courses by March 2021.

- External Commercial Borrowings and FDI to be enabled for education sector.

- Ind-SAT proposed for Asian and African countries as a part of Study in India program.

Economic Development

- Rs. 27,300 crores allocated for 2020-21 for development and promotion of Industry and Commerce.

- Investment Clearance Cell proposed to be set up:

- To provide “end to end” facilitation and support.

- To work through a portal.

- National Technical Textiles Mission to be set up

- New scheme NIRVIK to be launched to achieve higher export credit disbursement

- Turnover of Government e-Marketplace (GeM) proposed to be taken to Rs 3 lakh crore

- All Ministries to issue quality standard orders as per PM’s vision of “Zero Defect-Zero Effect” manufacturing.

Infrastructure

- Rs.100 lakh crore to be invested on infrastructure over the next 5 years.

- National Infrastructure Pipeline:

- Rs. 103 lakh crore worth projects; launched on 31st December 2019.

- A National Logistics Policy to be released soon

Highways

- Delhi-Mumbai Expressway and two other packages to be completed by 2023.

- Chennai-Bengaluru Expressway to be started.

- Proposed to monetise at least 12 lots of highway bundles of over 6000 Km before 2024.

Indian Railways

- More Tejas type trains to connect iconic tourist destinations.

- High speed train between Mumbai and Ahmedabad to be actively pursued.

- 148 km long Bengaluru Suburban transport project at a cost of Rs 18600 crore

- Indian Railways’ achievements:

- 550 Wi-fi facilities commissioned in as many stations.

- Zero unmanned crossings.

- 27000 Km of tracks to be electrified.

Ports & Water-ways

- Economic activity along river banks to be energised as per Prime Minister’s Arth Ganga concept.

Airports:

- 100 more airports to be developed by 2024 to support Udaan scheme.

- Air fleet number expected to go up from present 600 to 1200 during this time.

Electricity:

- “Smart” metering to be promoted.

Power:

- Rs.22, 000 crore proposed for power and renewable energy sector in 2020-21.

- Expansion of national gas grid from the present 16200 km to 27000 km proposed.

New Economy

- Fibre to the Home (FTTH) connections through Bharat-net to link 100,000-gram panchayats this year.

Caring Society

- Focus on:

- Women & child,

- Social Welfare;

- Culture and Tourism

- Allocation of Rs. 35,600 crores for nutrition-related programmes proposed for the FY2020-21.

- Rs.28, 600 crores proposed for women specific programs.

- Rs. 85, 000 crore proposed for 2020-21 for welfare of Scheduled Castes and Other Backward Classes.

- Rs. 53, 700 crores provided to further development and welfare of Scheduled Tribes.

- Enhanced allocation of Rs. 9,500 crores provided for 2020-21 for senior citizens and Divyang.

Culture & Tourism

- An Indian Institute of Heritage and Conservation under Ministry of Culture proposed; with the status of a deemed University.

- 5 archaeological sites to be developed as on-site Museums:

- Rakhigarhi (Haryana)

- Hastinapur (Uttar Pradesh)

- Shivsagar (Assam)

- Dholavira (Gujarat)

- Adichanallur (Tamil Nadu)

- Re-curation of the Indian Museum in Kolkata, announced by Prime Minister in January 2020.

- Museum on Numismatics and Trade to be located in the historic Old Mint building in Kolkata.

- Support for setting up of a Tribal Museum in Ranchi (Jharkhand).

- Maritime museum to be set up at Lothal- the Harrapan age maritime site near Ahmedabad, by Ministry of Shipping.

Environment & Climate Change

- PM launched Coalition for Disaster Resilient Infrastructure (CDRI) with Secretariat in Delhi.

- Second such international initiative after International Solar Alliance.

Governance

- Taxpayer Charter to be enshrined in the Statute will bring fairness and efficiency in tax administration.

- Major reforms in recruitment to Non-Gazetted posts in Government and Public sector banks:

- An independent, professional and specialist National Recruitment Agency (NRA) for conducting a computer-based online Common Eligibility Test for recruitment.

- A test-centre in every district.

- New National Policy on Official Statistics to promote use of latest technologies including AI.

- A sum of Rs. 100 crores allocated to begin the preparations for G20 presidency to be hosted in India in the year 2022.

Financial Sector

- Reforms accomplished in PSBs:

- 10 banks consolidated into 4.

- Rs. 3,50,000 crore capital infused.

- Deposit Insurance and Credit Guarantee Corporation (DICGC) permitted to increase Deposit Insurance Coverage to Rs. 5 lakhs from Rs.1 lakh per depositor.

- Government to sell its balance holding in IDBI Bank to private, retail and institutional investors through the stock exchange.

Financial Market

- FPI limit in corporate bonds increased to 15% from 9% of its outstanding stock

Disinvestment

- Government to sell a part of its holding in LIC by way of Initial Public Offer (IPO).

- XV Finance Commission (FC):

- XV Finance Commission has given its first report for FY2020-21

- Its final report for five years beginning 2021-22 to be submitted during the latter part of the year.

GST Compensation Fund:

- Balances due out of collection of the years 2016-17 and 2017-18 to be transferred to the Fund, in two instalments.

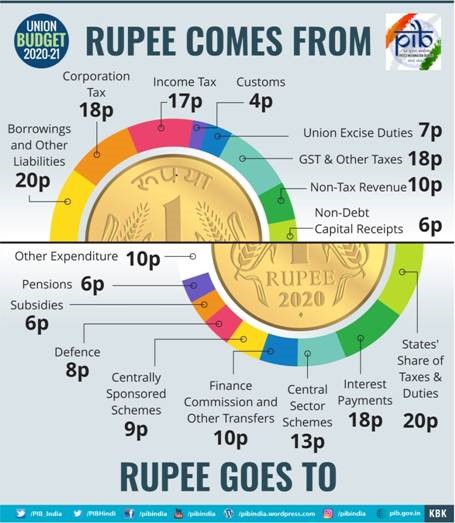

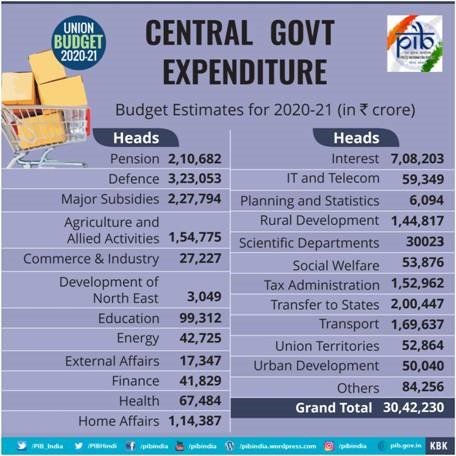

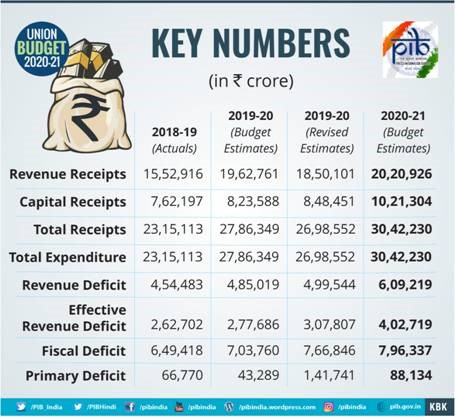

Economy in Numbers

- For the FY 2019-20:

- Revised Estimates of Expenditure: at Rs.26.99 lakh crore

- Revised Estimates of Receipts: estimated at Rs.19.32 lakh crore.

- For the FY 2020-21:

- Nominal growth of GDP estimated at 10%.

- Receipts: estimated at Rs.22.46 lakh cr

- Expenditure: at Rs.30.42 lakh cr.

- Fiscal deficit of 3.8% estimated in RE 2019-20 and 3.5% for BE 2020-21.

- Market borrowings:

- Net market borrowings: Rs.4.99 lakh crore for 2019-20 and Rs.5.36 lakh crore for 2020-21.

Direct Tax

|

Taxable Income Slab (Rs.) |

Existing tax rates |

New tax rates |

|

0-2.5 Lakh |

Exempt |

Exempt |

|

2.5-5 Lakh |

5% |

5% |

|

5-7.5 Lakh |

20% |

10% |

|

7.5-10 Lakh |

20% |

15% |

|

10-12.5 Lakh |

30% |

20% |

|

12.5-15 Lakh |

30% |

25% |

|

Above 15 Lakh |

30% |

30% |

Corporate Tax:

- Tax rate of 15% extended to new electricity generation companies.

- Indian corporate tax rates now amongst the lowest in the world.

Start-ups:

- Start-ups with turnover up to Rs. 100 crores to enjoy 100% deduction for 3 consecutive assessment years out of 10 years.

Cooperatives:

- Cooperative societies exempted from Alternate Minimum Tax (AMT) just like Companies are exempted from the Minimum Alternate Tax (MAT).

Tax Facilitation Measures

- Instant PAN to be allotted online through Aadhaar.

- Vivad Se Vishwas’ scheme, with a deadline of 30th June, 2020, to reduce litigations in direct taxes

- Faceless appeals to be enabled by amending the Income Tax Act.

Indirect Tax

- Excise duty proposed to be raised on Cigarettes and other tobacco product

- Anti-dumping duty on PTA abolished to benefit the textile sector

Unprecedented Milestones and Achievements of Indian Economy

- India now the fifth largest economy of the world.

- 7.4% average growth clocked during 2014-19 with inflation averaging around 4.5%.

- 271 million people raised out of poverty during 2006-16.

- India’s Foreign Direct Investment elevated to US$ 284 billion during 2014-19 from US$ 190 billion during 2009-14.

- Central Government debt reduced to 48.7% of GDP (March 2019) from 52.2% (March 2014).

Future Aim for sustaining India’s unique global leadership, driven by Digital Revolution

- Seamless delivery of services through Digital Governance.

- Improvement in physical quality of life through National Infrastructure Pipeline.

- Risk mitigation through Disaster Resilience.

- Social security through Pension and Insurance penetration.

ó ó ó ó ó ó ó ó ó ó