PREVIOUS

India's External Debt in March 2025

July 2 , 2025

248 days

1416

0

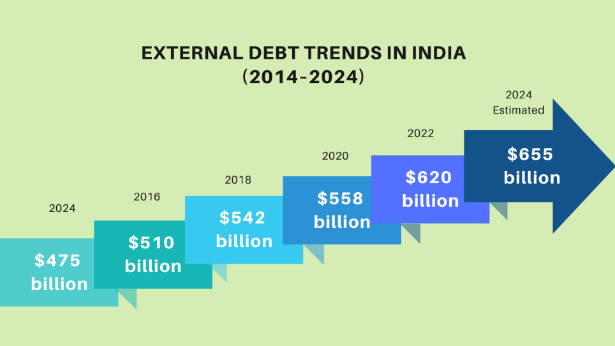

- India's external debt rose 10% to $736.3 billion by March 2025, up from $668.8 billion a year earlier.

- External debt as a share of GDP increased to 19.1% from 18.5% in the previous year.

- The rise was partly due to the US dollar appreciating against the rupee and other currencies, adding $5.3 billion in valuation effects.

- Excluding this effect, external debt would have grown by $72.9 billion instead of $67.5 billion.

- Debt by sector includes:

- $261.7 billion loans by non-financial corporations

- $168.4 billion by the government

- $202.1 billion by deposit-taking corporations (excluding RBI)

- Long-term debt (maturity over one year) increased to $601.9 billion, up by $60.6 billion.

- Short-term debt (maturity up to one year) share fell to 18.3%, but its ratio to forex reserves slightly rose to 20.1% from 19.7%.

- US dollar-denominated debt remains largest at 54.2%, followed by rupee (31.1%), yen (6.2%), SDR (4.6%), and euro (3.2%).

- By debt type, loans make up 34%, currency and deposits 22.8%, trade credit and advances 17.8%, and debt securities 17.7%.

- Forex reserves are enough to cover 11 months of imports, or 96% of the external debt outstanding.

Leave a Reply

Your Comment is awaiting moderation.